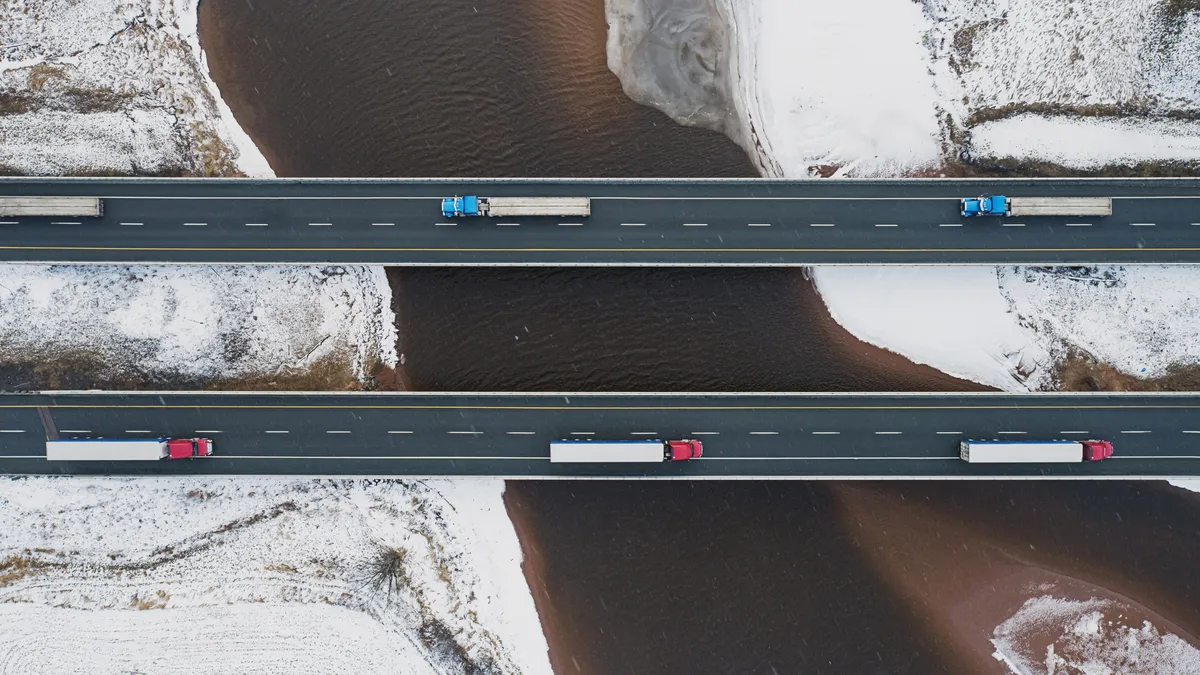

As we head into 2024, the trucking, logistics and retail industries find themselves navigating a complex landscape marked by economic uncertainty, diesel price swings and safety concerns. Questions about the financial health of the trucking industry, whether market volatility will persist and how these might impact consumers are front and center. Motive's inaugural Holiday Outlook Report offers valuable insights into what trucking and retail leaders are dealing with and provides advice on how to tackle the challenges that lie ahead.

State of freight: Volatility persists

In 2023, the trucking and retail industries experienced continued rebalancing following the economic surge driven by the pandemic. Oversupply of capacity has shrunk and constrained the market, a trend expected to continue into early next year. Carriers should adapt their plans accordingly. One key metric showing improvement is driver retention, with a 5% increase from 2022 to 2023. This improvement is especially notable in passenger transport, retail and warehousing, where more drivers are choosing to stay with their current employers. The desire for stability is evident, as carriers exit the market and new carrier starts trend downward.

Diesel price swings: Impact on financial health

Diesel prices, a significant input for carriers, saw major fluctuations in 2023. These fluctuations correlated closely with financial stress in the industry. For every 50-cent increase in diesel prices, there was a 30% rise in companies' financial stress. Small carriers are particularly impacted by this as they struggle to keep up with rising diesel costs and revenues remain under pressure.

Carrier exits and starts: Return to record highs

The number of carriers exiting the market increased in September, moving back toward the record highs seen in Q2. Simultaneously, new carrier starts saw a 10% drop, aligning with the overall trend in 2023. The market's return to more balance between consumer demand and carrier capacity relies on factors for which it has little control, like diesel price fluctuations, overall freight volumes and interest rates.

State of retail: Caution and delayed inventory ramp-ups

Retailers are gradually replenishing warehouse inventories in preparation for the holiday season. Higher inventories are reflected in Motive's Big Box Retail Index, which observes the frequency of carrier trips to retailer warehouses. Retailers not selling consumables like groceries may already be matching inventories closer to demand, which indicates a step toward market stabilization. Retailers are more likely to ramp up inventories closer to when they are needed, potentially creating slower periods in the lead-up to the holidays as consumer confidence lags.

State of safety: A critical concern during the holidays

Safety is a paramount concern during the peak freight holiday season, marked by factors such as severe weather and increased traffic. Severe weather conditions and busy roads create a higher risk of accidents, with last year seeing a 14% increase in critical speeding events during the holidays. Truck collisions more than doubled on December 23, and accidents correlated with severe weather conditions. Hours of service violations also tend to increase around the holidays.

Predictions for the holiday season and 2024: Navigating demand amid uncertainty

As we look ahead to the new year, several trends and challenges have emerged – but there are ways to prepare:

- The trucking market's contraction is expected to continue in light of ongoing economic uncertainties and excess capacity left over from the pandemic.

- Diesel and insurance prices should remain volatile in the first half of 2024, requiring carriers to adapt to price fluctuations and excess capacity.

- Driver retention may continue to improve, reflecting a broader job market trend of fewer people seeking job changes.

- With relatively weak holiday demand, retailers are operating leaner and keeping inventory levels low.

- Operational efficiency remains the key to success, as carriers try to maximize their bottom lines in the face of market contractions, cost volatility and safety concerns.

As the holiday season hits full stride, here are a few actionable steps that trucking, logistics and retail leaders can deploy to navigate the peak freight season and 2024:

- Improve efficiency: Look for opportunities to enhance operational efficiency across the board. The most seamless way to do this is by leveraging a unified Integrated Operations Platform like Motive to combine Driver Safety, Fleet Management, Equipment Monitoring and Spend Management in one place.

- Prioritize safety: Safety is more important than ever around the peak retail and, thus, peak freight holiday season, when events like severe weather and busy roads are stacked against operators. Implement AI-enabled tools like dash, side and rear cameras that provide 360-degree visibility and proactively coach drivers to make roads safer for everyone at this time of year.

- Assess cost structures: Conduct a thorough evaluation of your cost structures, identifying potential areas for optimization and cost reduction. Assessing your cost structures enables you to make informed decisions based on a realistic understanding of your financial landscape.

- Contingency planning: Develop contingency plans that cover a spectrum of scenarios, including best, most likely, and worst-case outcomes. This proactive approach equips your company to respond swiftly and effectively to unexpected challenges.

By implementing these strategies, trucking, logistics and retail executives can take proactive steps to ensure the safety, productivity and profitability of their business during the peak holiday season and the uncertain year ahead.

Download Motive's Holiday Outlook Report.

About the Author, Hamish Woodrow

Hamish joined Motive in 2019 and serves as its head of Strategic Analytics, leading a team of research and data professionals in developing and delivering insights on the transportation industry, global supply chains and macroeconomic trends for customers and the wider market. Before joining Motive, Hamish served as a data scientist and consultant working in the e-commerce and logistics sector. He started his career working in the energy sector, as an Engineer at Perenco (Europe’s largest independent oil company), working on facilities around the world on optimization problems. He holds an MSc from Imperial College London and a Masters in Engineering from the University of Bath.