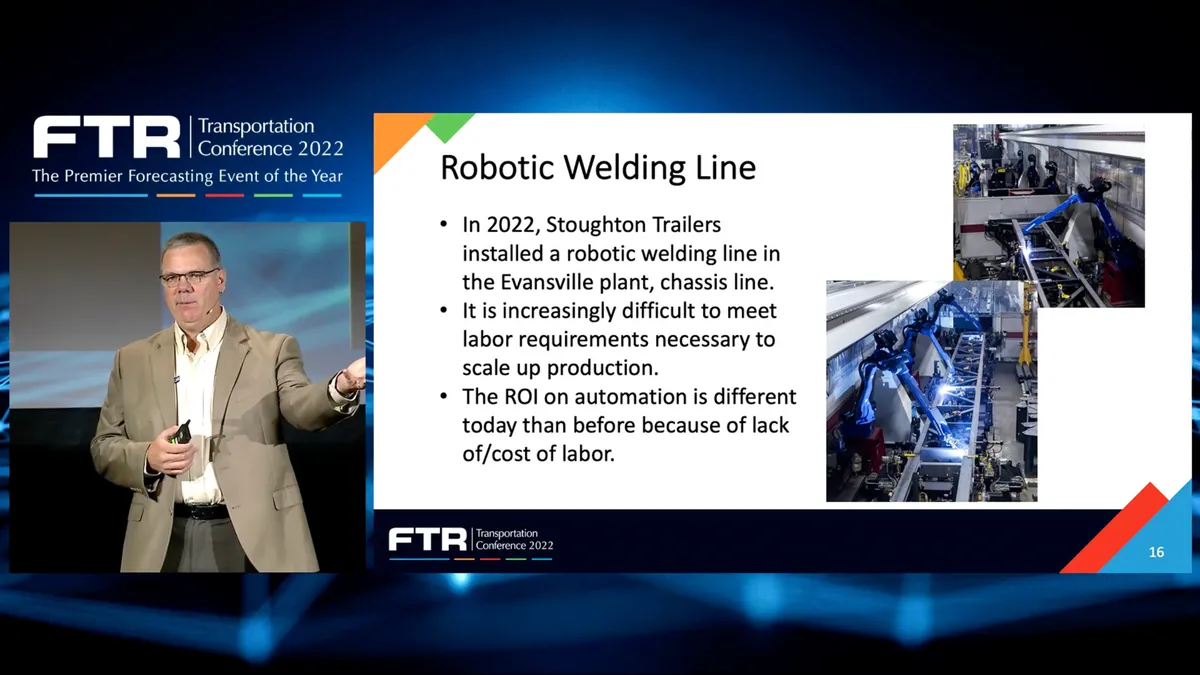

Stoughton Trailers debuted robotic welding capabilities this year on a chassis production line at its manufacturing plant in Evansville, Wisconsin, turning to the tech to help tackle staffing challenges.

The move reflects the increasing labor issues the OEM faces as it struggles to meet pent-up equipment demand, David Giesen, vice president of sales and marketing, said during remarks at the FTR Transportation Conference 2022 this month.

“We spent a lot of money putting in an automated, robotic welding line to build chassis,” Giesen said. “In the past, the return on investment was a different model than it is today. The reason it’s a different model is we cannot get the workers.”

While the welding line was costly, hiring five workers to perform a manufacturing task is far more difficult than it used to be, Giesen said. The OEM has been pleased with the automated tech’s results so far, its vice president added.

“Pretty impressive to watch these robots weld,” he said. “And as long as everything’s set up right, it’s all great.”

Stoughton, the fifth-largest dry van manufacturer in North America, is on pace to be the largest domestic producer of chassis by the end of the year. The company is hiring for a plant it added this year in Waco, Texas, and it signed a deal with a manufacturing partner in Mississippi, as it projects strong demand for chassis and trailers to continue through 2023.

The company plans to hire up to 125 new employees at its Waco facility.

A Stoughton spokesperson did not respond to a question about the number of workers at each site, the name of the Mississippi partner, or the number of open positions in Evansville the robotic welding line will allow it to eliminate.

“We could fill our backlog probably two or three times over for 2023 with the demand that is sitting there,” Giesen told conference attendees.

The company has begun placing orders for next year, but is hesitant to book business too far in advance because of supply constraints on components, Giesen said.

“I’m not going to book all that business out because I don’t know how many [pieces of equipment] per week I’m going to produce,” he said. “I don’t know what components per week I’m going to get.”

Chassis and trailers are made with many of the same parts, and Stoughton is working to balance increased chassis production with the capacity required for its trailer customers. The company has scaled up its domestic chassis manufacturing and plans to soon offer 20-foot and 40-foot chassis in addition to its current 53-foot intermodal units.

The company has a combined 1.3 million square feet of manufacturing space in nine facilities in the Wisconsin cities of Stoughton, Evansville and Brodhead, according to its website.

David Taube contributed to this story.