Detention and demurrage have been getting a lot of attention. Supply chain stakeholders have voiced concerns that congestion has slowed container movement, which leads to trucking companies and cargo owners racking up fees with ocean carriers.

A new report from Container xChange shows these charges have also become more expensive during 2021. The container-leasing company found that the average detention and demurrage charge more than doubled from 2020, increasing 104%. This translates to an increase of more than $666, according to the report.

Ocean carriers have said the charges are a necessary way to incentivize cargo and equipment movement. But to other observers, the supply chain is simply too congested for fees to aid in the goal of increasing container velocity.

Detention and demurrage got more expensive this year

Shippers and forwarders have always had a different opinion on detention and demurrage charges than carriers, said Florian Frese, the marketing lead for Container xChange.

"Short-term this might be difficult to understand for shippers but mid-term this will help reduce equipment scarcity and overall lower costs involved in moving goods/containers again," Frese said in an email. "When it’s completely out of the [shipper's] hand, communication between both [parties] is required though."

Fees: Incentives for fluidity or profit centers?

Matt Schrap, the CEO of the Harbor Trucking Association, said his organization's members struggle with per diem billing from the carriers. This is a fee charged per day until a container is returned to the port.

"People are being charged when they don't have the ability to bring [the container] back or pick it up," Schrap said, noting that the practice has gained a reputation for being a profit center for ocean liners.

Schrap's predecessor, Weston LaBar, who is now head of strategy for Cargomatic, fought against these fees during his time at the HTA. In February, the organization said it had disputed more than 3 million detention and demurrage charges in 2020.

"Detention and demurrage is well intentioned," LaBar said in an email. "However, currently the supply-chain is so backed up there is no need to incentivize the movement of cargo. Each element of the supply-chain is struggling with capacity and wants to move the freight, but it just isn't moving."

Long Beach, LA lead in detention and demurrage costs

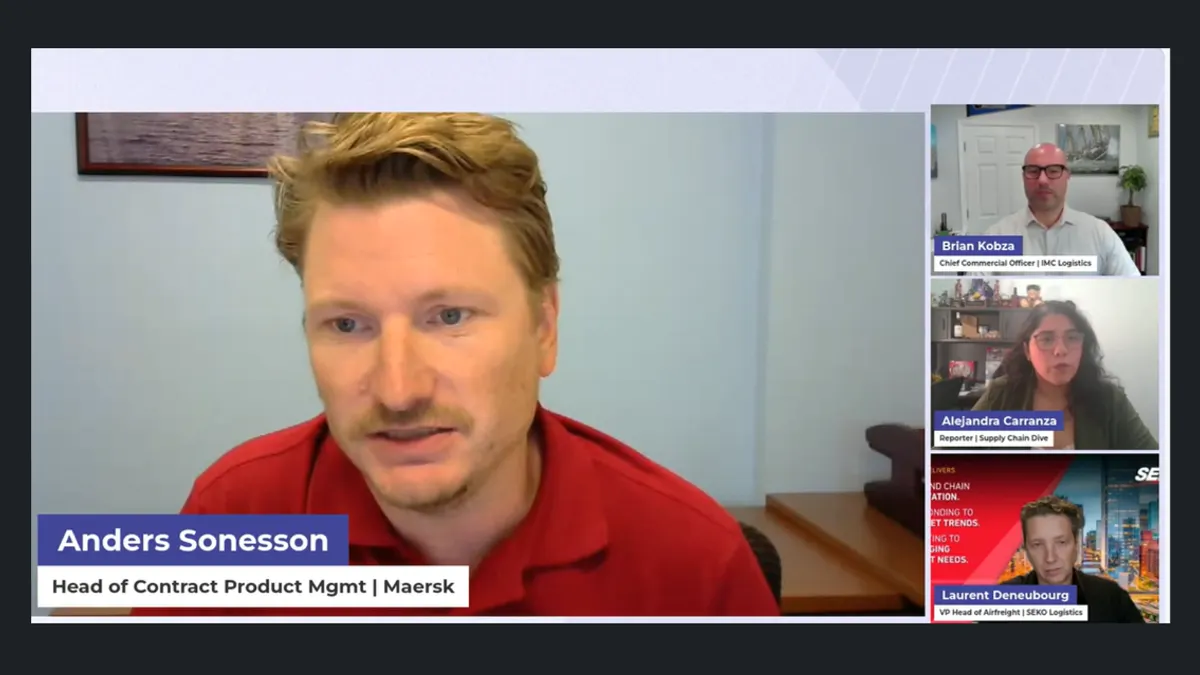

Vincent Clerc, the CEO of Maersk ocean and logistics, said detention and demurrage does serve its desired role of incentivizing cargo movement, "for the most part."

"But when you get into a situation where you have very high level of congestion, and where it becomes actually difficult for companies to get their hands on the cargo, then you can get into a situation where actually it doesn't work like that," Clerc said.

Detention and demurrage were hotly debated before the pandemic, but the resulting congestion throughout the supply chain has worsened the environment around the subject, said Josh Brazil, the vice president of marketing at project44.

Brazil noted that project44 doesn't track the cost of detention and demurrage, but it does follow dwell time, which shows how long containers remain in a given location. Dwell times have reached new highs at ports around the world recently because of congestion, but Brazil said it is beginning to come down at ports of loading and destinations. Dwell time fell at the California ports of Los Angeles, Long Beach and Oakland from May to June, he said.

Dwell time is also stabilizing at Yantian in China, after the port limited operating capacity due to a coronavirus outbreak. Loading dwell time fell to eight days the week of June 20, down from 27 days the week of June 13, according to data from FourKites.

Several carriers increase charges in LA

Clerc also said 40% of the trucking appointments made at the terminals in Southern California are no shows, suggesting that from this perspective, as a terminal operator, detention and demurrage can act as "a powerful incentive to ... create more fluidity."

He also noted that the historically low inventory throughout American businesses has resulted in another incentive for cargo owners to move their goods as quickly as possible.

Shippers bring concerns to Washington

Shippers' concerns about fees have been loud enough to make their way to legislators and into a recent congressional hearing.

Robert Gibbs, a Republican from Ohio, said the current environment led to "accusations of abuses regarding detention and demurrage charges, which I'll note ocean carriers and terminal operators deny."

The Federal Maritime Commission issued its final guidelines for detention and demurrage last year. But there have been accusations that carriers aren't following the guidelines.

"I've become more and more concerned about compliance with our rules on demurrage, and detention, and so we're going to begin an enforcement process," FMC Commissioner Rebecca Dye said in February.

Members of Congress, including Gibbs, called on the FMC to enforce these rules. And the agency has hinted it is taking steps toward enforcement action. But little has been seen in this area thus far.

An FMC spokesperson said in a recent email that the agency "is pursuing several approaches concerning detention and demurrage to bring ocean carriers and marine terminals into compliance. These activities include enforcement actions and conducting, for the first time, individual audits of carriers to ensure their compliance with the law."

The spokesperson declined to provide details on what enforcement actions are being pursued.

Narin Phol, the regional managing director of North America for Maersk, said he has had multiple meetings with the FMC. But he said, "it's very difficult to predict where this is going to end up based on the discussion that is going on."